Oral Health Capital Loan Fund

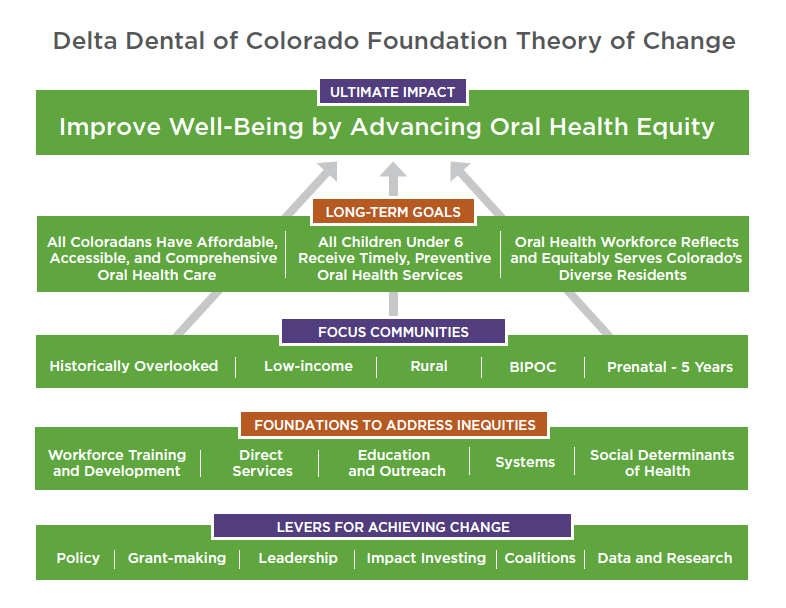

In addition to grant-making, which is guided by the initiatives, the foundation also works with community partners to offer mission-related investments (MRIs). These are financial investments that further an organization’s mission.

These mission-related investments are designed to provide funding for oral health–related capital needs of community-based dental providers, services, and clinics. The Oral Health Capital Loan Fund is intended to be equitably distributed across the state and urban/rural communities. The Fund closed on multiple loans during its first year in 2021. The Fund is managed in partnership with the Colorado Enterprise Fund (CEF), a locally based Community Development Financial Institution (CDFI). CDFIs are private-sector, financial intermediaries with community development as their primary mission.

MRIs can be another powerful tool to further our mission to advance oral health equity.

Loan Guidelines

DDCOF will provide loans to Colorado organizations that directly provide oral health care to their community. As the only dedicated oral health funder in Colorado, DDCOF appreciates the unique role we play in the safety-net dental delivery system, to include, oftentimes, being the only funder available to help with the purchase of oral health capital expenditures.

The loans can be used to fund oral health-related capital needs of community-based dental providers, services, and clinics. MRIs are available statewide but will be managed for equitable distribution across the state and across urban/rural communities.

How Does it Work?

Loan amounts no less than $50,000

1%–2.5% interest rate

0% origination fee. Typical 3% fee is subsidized by DDCOF

Coaching from CEF included at no cost to loan recipient

Who Is Eligible?

Interested in a Loan?

The Oral Health Capital Loan Fund is temporarily on pause for assessment and evaluation. We hope to make this tool available again in 2025.